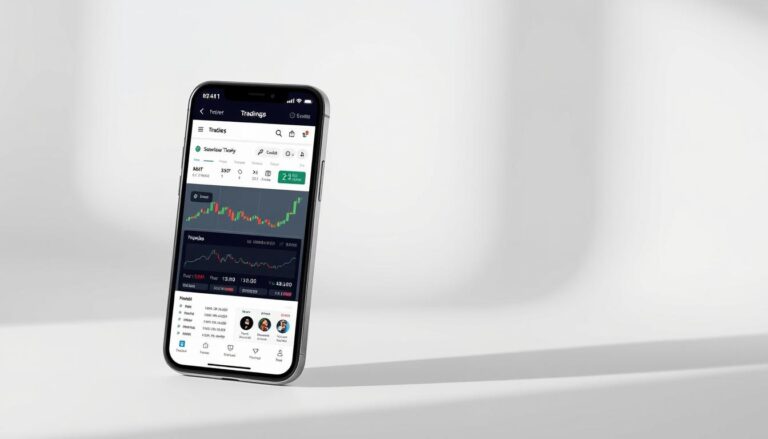

Tradovate Trading Platform for Investors

Modern investors demand tools that keep pace with fast-moving markets. A cloud-based futures trading platform now offers day trading margins starting at $50, paired with no mandatory funding thresholds. This approach removes traditional barriers, letting traders focus on strategy rather than account minimums.

The system provides instant access to live market data and advanced analytics through any web browser. No downloads mean users can test strategies or review historical patterns within minutes. Built specifically for futures, every feature aligns with the unique rhythms of commodity and index markets.

Real-time charts and risk management tools sit beside seamless order execution. Whether analyzing trends or adjusting positions, the interface stays intuitive without sacrificing depth. Traders gain professional-grade capabilities wrapped in a design that prioritizes clarity over complexity.

This environment supports both newcomers and seasoned professionals. With no hidden fees and transparent pricing, it reshapes how individuals engage with derivatives. The platform’s architecture ensures reliability during volatile sessions, a critical factor for time-sensitive decisions.

Introducing Tradovate: A Modern Trading Experience

Futures trading has entered a new era of technological sophistication and user-centric design. This cloud-based solution delivers over 40 specialized tools tailored for commodity and index markets, wrapped in an interface that prioritizes clarity. Traders gain instant access without downloads, streamlining their workflow across devices.

Overview of the Platform and Its Unique Features

The architecture breaks from traditional software models, offering institutional-grade capabilities through any web browser. From basic order execution to complex algorithmic strategies, every tool addresses modern market challenges. Real-time analytics and risk management features update continuously, keeping pace with volatile sessions.

Designed for Futures Traders and Investors

Seasoned professionals and newcomers alike benefit from intuitive navigation paired with advanced functionality. Custom order types and mobile synchronization align with contemporary trading habits. Exclusive focus on futures ensures tools adapt to market-specific patterns, providing insights general platforms miss.

Advanced Futures Trading Tools and Market Data

Cutting-edge analysis requires more than basic charts and indicators. Modern platforms now combine real-time market data with specialized tools designed for high-stakes decision-making. These systems transform raw numbers into actionable insights, giving traders an edge in fast-paced environments.

40+ Futures Trading Tools for Advanced Analysis

Tradovate’s toolkit includes over 40 features built specifically for futures market dynamics. Technical traders benefit from multi-timeframe charting, customizable indicators, and order flow visualization. Risk management tools like position calculators and automated stops integrate directly with trading workflows.

The platform’s data infrastructure streams live price feeds and volume metrics. This allows users to spot emerging trends across commodities and indices. Advanced order types, including trailing stops and conditional triggers, execute strategies with surgical precision.

On-Demand Streaming Market Replay for Strategy Testing

Historical market data replay lets traders test approaches under real past conditions. Users can revisit specific events like earnings announcements or Fed rate decisions. This feature streams archived sessions with original timing and volatility intact.

Strategy validation becomes more than theoretical when applied to actual price movements. The tool reveals how positions would have performed during market shocks or rallies. By analyzing these simulations, traders refine entry points and risk parameters before deploying capital.

Seamless Integration and Automated Trading Strategies

Adaptable platforms now let traders merge analytical tools with execution systems effortlessly. This synergy transforms how strategies develop, combining personalized workflows with real-time market responsiveness.

Third-Party Charting Integrations and Custom Dashboards

Traders maintain their preferred charting tools while accessing live market data and order execution. Compatibility with popular analytical software eliminates switching costs. Custom dashboards display key metrics, charts, and alerts tailored to individual trading strategies.

Cross-device synchronization ensures layouts stay consistent across desktops, tablets, and phones. New integrations roll out regularly based on user requests, keeping the platform aligned with evolving needs. Advanced users even connect proprietary tools through API access.

Automated Trading Bots to Execute Custom Strategies

Through TradersPost integration, traders automate rule-based systems without coding expertise. Bots execute orders based on technical indicators, price thresholds, or volatility patterns. Backtesting against historical data validates approaches before live deployment.

Automation ranges from basic alerts to complex algorithms managing multiple positions. This flexibility suits both index and commodity markets. Users refine strategies continuously, adapting to shifting conditions while minimizing emotional decisions.

Customer Support, Security, and Cross-Device Flexibility

Reliable infrastructure forms the backbone of any trading operation. Tradovate combines robust assistance channels with military-grade security protocols, creating a safety net for active market participants. This blend of human expertise and technological safeguards ensures uninterrupted access to critical tools.

Live Chat and Phone Support for Real-Time Assistance

The Illinois-based support team operates like a financial lifeline during volatile sessions. Traders connect instantly through phone or live chat, receiving guidance on order execution or platform features. This real-time assistance prevents costly delays when seconds determine profit margins.

Secure Cloud-Based Order Management and Data Protection

Orders remain protected during internet outages through cloud-based storage systems. Advanced encryption shields personal information and trading history from cyber threats. The broker’s architecture automatically backs up custom dashboards, preserving unique workflow configurations across devices.

Native apps for Mac, PC, and mobile platforms maintain feature parity. Traders switch seamlessly between desktop analysis and mobile position adjustments. Regular security audits and clearing house partnerships ensure compliance with strict financial regulations.

Final Insights on Tradovate for UK Investors

UK investors navigating global derivatives markets gain a strategic edge through streamlined access and institutional-grade tools. The broker removes traditional hurdles with $50 day-trading margins and zero deposit minimums, making futures participation viable for diverse capital levels.

Direct connectivity to CME Group’s four exchanges (CME, CBOT, NYMEX, COMEX) delivers unmatched market data depth. Each exchange operates under specific rules, offering distinct commodities and indices. Traders analyze trends across energy, metals, or agricultural sectors through real-time feeds.

Automated strategies thrive here. Built-in tools let users backtest systems against historical volatility patterns before live deployment. Cloud-based infrastructure simplifies cross-border trade execution while maintaining compliance with international clearing standards.

Risk controls adapt to round-the-clock sessions. Position sizing tools and exposure alerts help UK investors manage time-zone challenges. With transparent funding structures and robust security, the platform aligns with professional trader needs while welcoming new entrants.