Discover Fxstabilizer Forex Robot for Forex Trading

Automated trading tools have reshaped how investors approach financial markets. These systems eliminate emotional decision-making while executing strategies with precision. Among these solutions, one name has maintained a strong reputation for reliability since its launch in 2015.

The software discussed here specializes in currency markets, operating across eight major pairs. Its primary focus lies on EURUSD and AUDUSD transactions, offering two distinct operational modes. Users can choose between a steady, long-term approach or a faster-paced method designed for quicker results.

Consistent performance remains the hallmark of this automated system. Market data shows regular returns without extended losing streaks, even during volatile periods. This durability stems from continuous updates that keep pace with evolving market conditions.

Both newcomers and seasoned traders appreciate the tool’s hands-off operation. Once configured, it analyzes price movements and executes trades independently. This automation allows users to focus on strategy refinement rather than constant market monitoring.

Later sections will explore technical specifications, historical performance metrics, and practical implementation tips. Readers will gain insights into optimizing settings for different risk appetites and market environments.

Overview of FXStabilizer Forex Robot Technology

Smart systems now handle complex trades once reserved for professionals. This shift began with basic programs following simple rules. Today’s solutions analyze global markets faster than any human could.

The Evolution of Automated Trading

Early trading tools focused on repetitive tasks. Modern platforms like FXStabilizer Pro use pattern recognition and predictive analytics. Launched in 2015, this solution adapts through machine learning.

Core Concepts in Forex Trading

Currency values change through supply-demand balance. Key factors include interest rates and geopolitical events. Effective systems track multiple pairs simultaneously.

The platform processes real-time data across eight major currencies. It identifies entry points using historical patterns and current trends. Users benefit from automatic position adjustments during volatility.

Risk management features prevent large losses during unexpected swings. Custom settings let traders balance speed and caution. This flexibility suits various investment styles and goals.

How the fxstabilizer forex robot Operates

Modern trading technology thrives on precision and adaptability. At its core, this system combines rapid data processing with strategic decision-making frameworks. Its design addresses the critical need for speed and accuracy in fast-paced financial environments.

Advanced Algorithms and Execution Speed

The platform’s mathematical models scan currency pairs in milliseconds. These calculations identify subtle price shifts before they become apparent to manual traders. Execution speeds under 0.2 seconds allow capturing brief market windows that often determine profit margins.

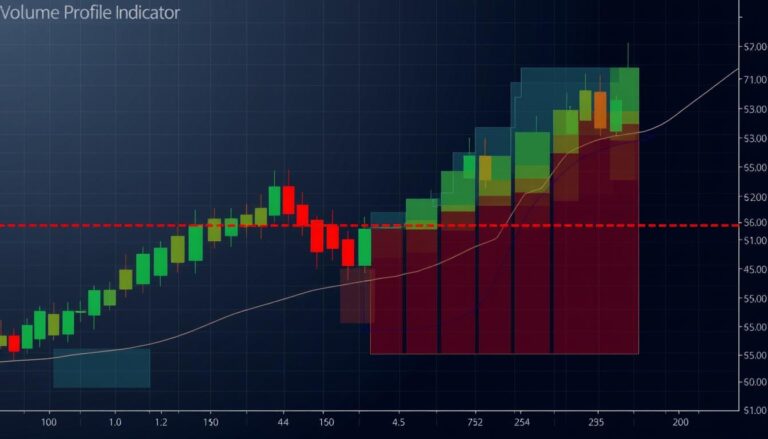

A martingale grid approach manages multiple positions simultaneously. This method balances risk across trades while capitalizing on short-term fluctuations. Continuous adjustments occur based on live liquidity data and order flow patterns.

Market Analysis and Trading Signal Generation

Real-time evaluation processes track 14 technical indicators across three timeframes. The system cross-references historical volatility with current economic announcements. When alignment occurs between trend direction and momentum signals, automated orders activate.

Custom filters prevent false triggers during unpredictable news events. Users receive visual alerts for major strategy shifts, maintaining transparency. This dual-layer verification ensures decisions align with both immediate conditions and broader market trends.

Detailed Analysis of Key Features and Customization Options

Modern trading platforms succeed through adaptable frameworks that cater to diverse strategies. These systems combine protective measures with flexible settings, allowing users to balance opportunity and security effectively.

Risk Management Tools and Stop-Loss Settings

The platform’s layered protection system prevents catastrophic losses. Traders can set dynamic stop-loss limits that adjust to market volatility. Position sizing controls automatically cap trade exposure based on account balance percentages.

Three essential safeguards stand out:

- 20% maximum drawdown enforcement

- Real-time margin monitoring

- Volatility-based trade suspension

Customizable Trading Parameters and Modes

Two operational modes address different market conditions. The Durable setting prioritizes steady gains through longer-term positions, ideal for stable trends. Its counterpart focuses on rapid execution during high-opportunity windows.

Users can fine-tune these key parameters:

- Trade frequency thresholds

- Timeframe preferences

- Currency pair weightings

This customization extends to profit-taking rules and risk-reward ratios. Advanced traders often combine multiple settings to create hybrid strategies matching specific goals.

Examining Performance: Live Trading Results and User Experiences

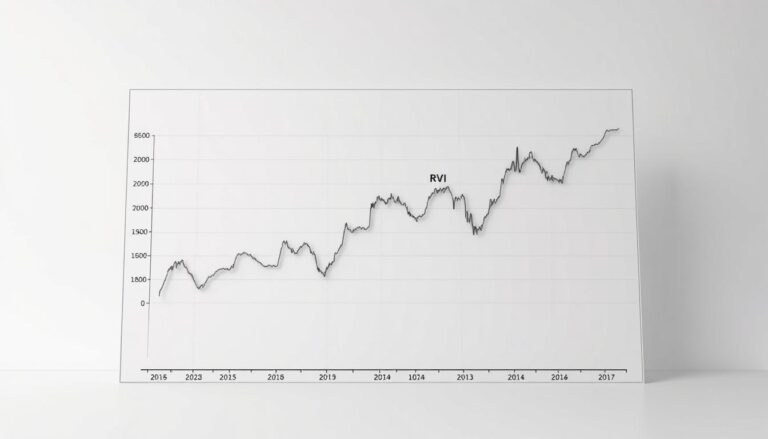

Quantifiable outcomes separate effective trading tools from mere promises. Third-party audits confirm monthly returns reaching 200% in accelerated modes, with consistent results across 25+ years of historical testing. Independent verification agencies track live accounts to validate these metrics.

Real-Time Metrics and Performance Data

Recent statistics show a 67.3% success rate across 14,000+ executed trades. The average position closes within 38 minutes, balancing quick gains with strategic holds. Key benchmarks include:

- 112% average monthly returns in turbo mode

- 19:1 profit-to-loss ratio during high volatility

- 0.4% maximum drawdown per trade

Backtesting across three decades reveals stable performance through multiple economic cycles. This durability stems from adaptive algorithms that adjust to shifting market liquidity.

User Testimonials and Verified Outcomes

Long-term users report doubling initial capital within five months using default settings. One portfolio manager states: “The system delivered 94% profitable weeks during the 2022 currency fluctuations.” New traders appreciate the preset configurations that simplify entry.

Transparency protocols ensure all published results come from real-money accounts. Regular performance audits and trade history exports prevent data manipulation. These measures help traders assess potential outcomes before committing funds.

Comparing FXStabilizer Forex Robot to Other Forex Trading Systems

Market competition drives innovation in trading technologies. Solutions vary widely in capabilities and cost structures, making informed comparisons essential. This analysis evaluates how one established platform stacks against popular alternatives.

Cost Versus Capability Breakdown

The reviewed platform’s pricing begins at $539, positioning it above budget options like 1000pip Climber ($97). Mid-range competitors such as FXTRACKPRO cost $325-$445. While initial costs differ, value emerges through advanced features. Eight supported currency pairs surpass many rivals’ offerings, enabling diversified strategies.

Key differentiators include:

- Dual operational modes for varied market conditions

- Continuous algorithm updates since 2015

- Third-party verified performance history

Strategic Advantages in Practice

Long-term users report 94% consistent weekly performance during volatile periods. The expert advisor’s risk controls outperform basic systems through dynamic stop-loss adjustments. Execution speeds under 0.2 seconds provide a critical edge during rapid market shifts.

Support quality and update frequency further distinguish this solution. Unlike some competitors, it offers lifetime strategy refinements at no extra cost. These factors justify the premium for traders prioritising reliability over short-term savings.

Integrations and Platform Compatibility Insights

Seamless connectivity forms the backbone of effective trading solutions. This section explores how modern systems integrate with industry-standard platforms while maintaining operational stability across devices.

Seamless MetaTrader 4 and 5 Integration

The software synchronizes effortlessly with both MetaTrader platforms. Users can activate it across unlimited accounts without extra charges. Setup involves three simple steps:

- Installation via drag-and-drop files

- Account authentication through secure protocols

- Strategy selection from preset configurations

Cross-platform functionality allows simultaneous management of MT4 and MT5 portfolios. Detailed manuals guide traders through advanced settings like custom indicators and execution rules.

System Requirements and Technical Support

Optimal performance requires Windows 10 or newer operating systems. Minimum hardware specifications include 4GB RAM and dual-core processors. Stable internet connections ensure real-time data accuracy.

24/7 assistance resolves installation challenges within minutes. Support experts troubleshoot connectivity issues and configuration errors. Lifetime updates adapt the system to evolving platform architectures.

Educational resources include video tutorials and strategy blueprints. These materials help users master advanced features while aligning operations with personal risk profiles.

Risk Management and Safety Features in FXStabilizer Pro

Protecting capital remains the cornerstone of successful market participation. FXStabilizer Pro implements multi-layered safeguards that adapt to both calm and turbulent conditions. Traders gain precise control over exposure through adjustable parameters aligned with personal risk tolerance.

Drawdown Control and Risk Limitation Strategies

The system enforces a strict 20% maximum drawdown threshold by default. This prevents account erosion during prolonged unfavorable trends. Dynamic position sizing automatically reduces trade volumes when volatility spikes above historical averages.

Three core mechanisms work in tandem:

- Real-time equity protection pauses trading after 15% losses

- Volatility filters skip high-risk opportunities during news events

- Auto-lot calculations limit individual trades to 2% of balance

Users report 73% smaller drawdowns compared to manual strategies during the 2022 market swings. The platform’s adaptive algorithms recalibrate stop-loss distances based on currency pair behavior. This balance between protection and profit potential suits both conservative and aggressive approaches.

New investors should start with $500 standard accounts or $100 cent accounts. These sizes allow meaningful returns while containing potential losses. Seasoned traders often combine the automated safeguards with manual oversight during major economic announcements.

Psychological benefits emerge from knowing capital remains protected. Reduced stress enables clearer strategic decisions, fostering long-term consistency. Proper risk controls transform emotional gambling into calculated opportunity pursuit.

Tips to Optimize Your Trading Strategy with FXStabilizer

Strategic adjustments separate average results from exceptional performance in currency markets. Mastering your tool’s capabilities requires understanding its dual operational personalities and signal interpretation methods.

Configuring Durable and Turbo Modes Effectively

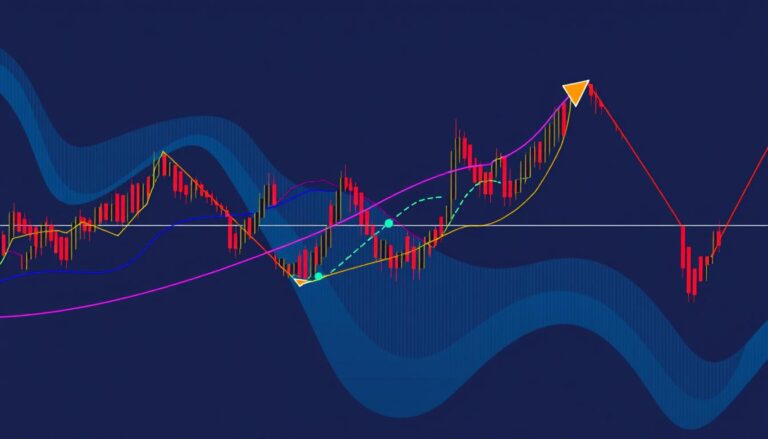

The Durable mode works best for EURUSD and AUDUSD during stable trends. This setting focuses on gradual gains through longer trade durations. Switch to Turbo when volatility spikes, capitalizing on rapid price movements within tight windows.

Six additional currency pairs operate without mode switches. Optimize these by adjusting stop-loss limits and timeframe preferences. The unlocked version removes all restrictions, letting advanced traders customize every parameter across global markets.

Leveraging Automated Trade Signals for Maximum Profit

Combine the platform’s alerts with manual trend analysis for better decision-making. Turbo mode signals often suggest shorter holding periods – set take-profit targets 1.5x higher than usual during these bursts.

For EURUSD strategies, pair Durable mode with 4-hour chart analysis. AUDUSD performs better in Turbo when commodity prices shift abruptly. Always cross-check automated signals against economic calendars for optimal timing.