XM MT4 Trading: Guide and Platform Insights

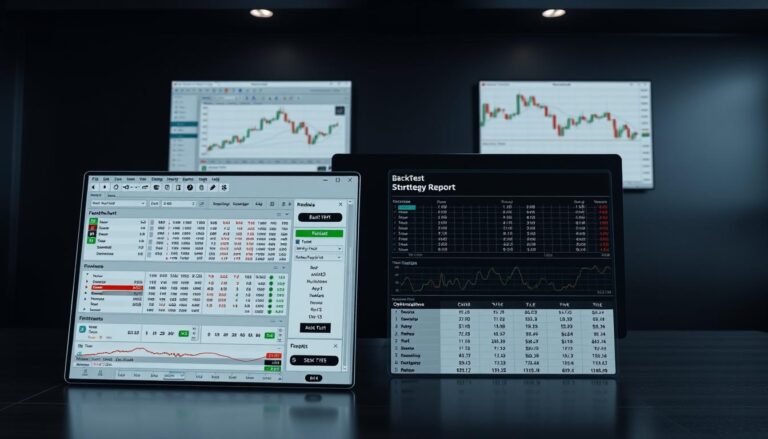

Successful trading starts with choosing the right tools. This guide explores one of the most stable and versatile platforms available today, developed through a partnership with MetaQuotes Software Corp. Traders gain access to industry-standard technology trusted by millions worldwide.

The MetaTrader application combines powerful features with user-friendly design. Users can trade forex, commodities, stock indices CFDs, and energy products all in one place. This diversity makes it suitable for both beginners refining strategies and experts executing complex trades.

Flexibility defines this environment. No requotes or execution rejections mean smoother transactions, while advanced charting tools help analyze market trends. The platform’s global accessibility ensures traders can operate seamlessly across time zones.

This section lays the groundwork for understanding how to maximize these tools. Later chapters will detail installation steps, customization options, and techniques to enhance trading performance. Discover why professionals consistently choose this solution for its reliability and comprehensive asset coverage.

Understanding XM MT4 Trading and Its Benefits

Navigating global markets demands platforms built for flexibility and speed. The MetaTrader 4 environment offers traders a blend of precision tools and adaptable features, making it ideal for diverse strategies. Whether analyzing trends or executing orders, the platform’s design prioritizes efficiency without compromising depth.

Key Advantages of the Platform

High customizability defines the experience. Traders access over 50 technical indicators, from moving averages to momentum oscillators. These tools help identify patterns across forex, commodities, and indices. Order execution options like market, limit, and stop-loss orders ensure precise trade management.

Automation elevates efficiency. Proprietary algorithms and Expert Advisors (EAs) let users automate strategies. One-click trading and trailing stops simplify risk management, while partial execution allows splitting large orders. Stability during volatile periods ensures reliability.

Diverse Trading Instruments and Customization

The application supports multiple asset classes on one screen. Charts for currency pairs or oil prices can coexist, enabling real-time comparisons. Drag-and-drop functionality streamlines workspace adjustments, saving time during fast-moving sessions.

Users tailor alerts, templates, and scripts to match their workflow. This adaptability suits both short-term scalpers and long-term investors. With tools for every style, the platform bridges strategy development and real-world execution seamlessly.

Downloading and Installing XM’s MT4 for Windows and Mac

Setting up a reliable trading platform begins with a smooth installation process. Both Windows and Mac users can access the software directly from official sources, ensuring security and compatibility. Follow these steps to get started quickly.

Installation Process for Windows Version

- Visit the provider’s website and locate the Windows setup file named “xmglobal4setup.exe”.

- Double-click the file and select “Yes” when the User Account Control prompt appears.

- Review the license terms, click “Next”, and wait for the installation to complete automatically.

Security software might temporarily block the download. Temporarily disable firewalls if needed, then reactivate them post-installation. A desktop shortcut appears for immediate access.

Steps for Installing on Mac OS

- Download the “MetaTrader4.dmg” file from the same trusted source.

- Open the downloaded file and drag the application icon into the Applications folder.

- Right-click the installed file and select “Open” to bypass macOS security restrictions.

If the system blocks the launch, navigate to Security Settings and approve the application manually. The process takes under two minutes for most users.

Always verify you’ve selected the correct operating system version before starting the download. Incorrect files cause installation errors and delays. Once set up, traders gain instant access to global markets through a stable interface.

Exploring XM Trading Platform Features

Choosing between MetaTrader versions depends on strategy complexity and analytical needs. While both platforms deliver robust tools, their capabilities cater to different trader profiles. This comparison highlights critical distinctions to help users optimize their workflow.

Comparing MT4 and MT5 Functionality

Charting flexibility separates these platforms. MetaTrader 4 provides 9 timeframes, from 1-minute to monthly charts. MT5 triples granularity with 21 intervals, including 2-minute and 20-minute views. This suits traders analyzing micro-trends in volatile markets.

Technical analysis tools differ significantly. MT4 includes 50 indicators, while MT5’s 80+ built-in tools offer deeper insights. The newer mt5 application also enhances backtesting through cross-market simulations. Traders can test strategies across multiple assets simultaneously.

Order execution evolves with MT5’s stop limit orders, adding precision to trade entries. Processing upgrades reduce latency by 30% compared to MT4, crucial for rapid-fire strategies. Both versions maintain reliable execution without requotes, aligning with XM’s quality standards.

Workspace customization favors MT5. Features like dockable charts and economic calendar integration streamline multitasking. While MT4 remains popular for EA compatibility, MT5’s expanded toolkit appeals to data-driven traders seeking advanced trading tool integrations.

Enhancing Execution and Minimizing Latency with XM

Milliseconds decide outcomes in modern trading. Latency – the delay between order initiation and execution – directly impacts profit margins. This section reveals how traders optimize connectivity for the mt4 mt5 application to stay competitive.

Understanding Latency and Its Impact on Trading

Every order travels through multiple nodes before reaching broker servers. XM’s UK-based infrastructure shows ping times under 102ms, while distant servers like Singapore (405ms) create noticeable delays. High latency causes:

- Slippage during news events

- Partial order fills

- Missed entry/exit points

Leveraging VPS and Optimized Connectivity

Pro traders use VPS servers near XM’s data centers. London-based solutions cut latency by 60% compared to residential connections. Key optimization steps:

- Select VPS providers with UK server locations

- Disable non-essential background processes

- Use wired internet connections for stability

Automated strategies on mt5 platforms benefit most from these tweaks. A 50ms improvement can increase annual returns by 12% for high-frequency systems.

Mastering xm mt4: Transitioning Between Demo and Real Accounts

Streamlining your trading workflow starts with efficient account navigation. MetaTrader’s design allows single installation access to both practice and live environments. Traders avoid redundant downloads while testing strategies or scaling operations.

Seamless Switching from Demo to Real Trading

Access the File menu and select Log in to Trading Account. Enter credentials received during account opening to switch modes instantly. Demo accounts remain vital for refining techniques without financial risk.

Logging Into and Managing Multiple Accounts

One platform supports unlimited profiles. Use the same login details across desktop, mobile, or WebTrader interfaces. This flexibility lets traders monitor diverse portfolios or compare strategies side-by-side.

Credentials sync automatically, eliminating re-entry. Whether practicing with a demo account or executing live trades, MetaTrader maintains consistent performance. This approach saves time while ensuring readiness for market opportunities.