Ichimoku Cloud metatrader Indicator for MT4 Trading Strategies

Many trading platforms offer a vast array of technical tools. For a trader, this can lead to cluttered charts and confusing signals. The challenge is finding a single indikator that provides a complete market picture.

The Ichimoku Cloud metatrader tool stands out as a comprehensive solution. It combines several analytical functions into one visual package. This powerful indikator helps assess trend direction, momentum, and key support or resistance zones simultaneously.

Its design is valuable across various pasar types. This includes forex, cryptocurrencies, and stocks. The ichimoku cloud gives traders a significant edge by simplifying complex data.

This article will guide you through its core components. You will learn practical strategies for the MT4 platform. The goal is to help you use this tool effectively in your daily analysis.

Introduction to Ichimoku Cloud: A Comprehensive Overview

Goichi Hosoda’s pioneering work in the 1930s laid the foundation for what would become one of the most complete technical analysis systems. This Japanese journalist dedicated his career to developing a tool that could provide traders with immediate market insights.

Understanding the Concept and Origins

The name ichimoku kinko hyo translates to “equilibrium chart at a glance.” This meaning perfectly captures the system’s core philosophy. Hosoda spent thirty years refining his methodology before releasing it publicly in 1969.

His goal was to create an indikator teknikal that offered comprehensive gambaran of market conditions. The system provides valuable informasi about harga movement and tren direction simultaneously.

The Evolution into a Complete Trading Tool

What began as a simple trend-following concept evolved into a sophisticated trading system. The ichimoku cloud now addresses multiple analytical needs in one framework.

It identifies support and resistance levels while measuring momentum strength. This holistic approach helps traders make informed decisions based on comprehensive harga analysis and tren assessment.

The second ichimoku kinko hyo component enhances its ability to filter market noise. This creates clearer trading signals for various financial instruments.

What is Ichimoku Cloud metatrader?

For traders seeking an all-in-one solution, the Ichimoku Kinko Hyo offers multiple analytical functions in a single visual display. This comprehensive indikator provides immediate insights into market conditions without cluttering the chart.

The system functions as a complete trading framework rather than just a single tool. It integrates trend analysis, momentum measurement, and support resistance identification simultaneously.

Traders appreciate how this approach delivers a holistic view of market dynamics. The indikator works effectively across various timeframes and financial instruments.

One key advantage is its ability to filter out market noise while projecting future level areas. This creates clearer signals for informed trading decisions.

The tool serves different trading styles equally well. Day traders, swing traders, and long-term investors all benefit from its versatile application.

Experienced users can quickly assess arah tren direction and momentum strength at a glance. This efficiency replaces the need for multiple separate analytical tools.

Market participants gain valuable harga context and future projections. The system’s comprehensive nature simplifies complex harga analysis into actionable insights.

Decoding the Key Components of Ichimoku Kinko Hyo

The ichimoku kinko hyo system comprises five distinct komponen that work together to deliver comprehensive market analysis. Each element serves a specific function while contributing to the complete trading picture.

Tenkan-sen and Kijun-sen: Fast and Slow Lines

The tenkan-sen kijun-sen pairing forms the core momentum indicators. The tenkan kijun relationship shows short-term versus medium-term price movements.

These garis use different periode calculations to filter market noise. Their crossover signals often indicate potential tren changes.

Senkou Span A & Senkou Span B: Crafting the Cloud

The senkou span elements create the distinctive visual feature of this system. Senkou span A combines the conversion and baseline calculations.

Senkou span B uses a longer timeframe for broader market perspective. Together they form the predictive cloud that projects future support and resistance.

Chikou Span: A Marker for Trend Confirmation

The chikou span provides unique lagging confirmation of current harga action. This component plots the closing price backward for historical comparison.

Traders use the chikou span position relative to past harga to validate tren strength. It completes the multi-timeframe analysis framework.

How the Ichimoku Indicator Works in MT4 Trading

Traders can quickly assess market conditions through the visual framework provided by this indikator ichimoku. The system processes multiple data points to generate clear sinyal for informed decisions.

Signal Generation and Trend Identification

The indikator ichimoku creates sinyal through component interactions. Price position relative to the cloud determines the overall market tren direction.

When price trades above the cloud, the arah tren is considered bullish. Below the cloud indicates bearish conditions. Inside suggests consolidation or uncertainty in the pasar.

The system measures kekuatan through line crossovers and cloud thickness. Thicker areas represent stronger support or resistance levels. This helps traders gauge market conviction.

Chikou Span provides crucial confirmation of pergerakan harga. Its position relative to historical price validates the current tren. This lagging component completes the analysis framework.

This approach works best in trending pasar conditions. Sideways markets may produce less reliable signals. The visual nature simplifies complex trading decisions.

Setting Up Ichimoku Cloud on MetaTrader 4

Applying this powerful analytical tool on MetaTrader 4 requires just a few simple steps. The platform includes this comprehensive indikator in its standard package. Traders can quickly access it without additional downloads.

Installation via the Insert Menu

Users begin by opening their desired chart in MT4. They navigate to Insert > Indicators > Trend > Ichimoku Kinko Hyo. A settings window appears with default periode values of 9, 26, and 52.

These standard periode settings correspond to traditional trading timeframes. Clicking OK immediately applies the indikator to the chart. All five components become visible as distinct garis.

Customizing Visual Settings for Better Clarity

Many traders prefer adjusting the default tampilan for better readability. They can modify colors for each garis to create clear visual separation. This helps distinguish between different components during analysis.

The cloud area can also receive color adjustments for better contrast. These customizations make interpreting price data more efficient. Saved templates allow quick application across multiple charts.

Strategies for Effective Trading with Ichimoku Cloud

The true strength of this analytical framework emerges when traders combine multiple sinyal for confirmation. This approach increases reliability across various market conditions.

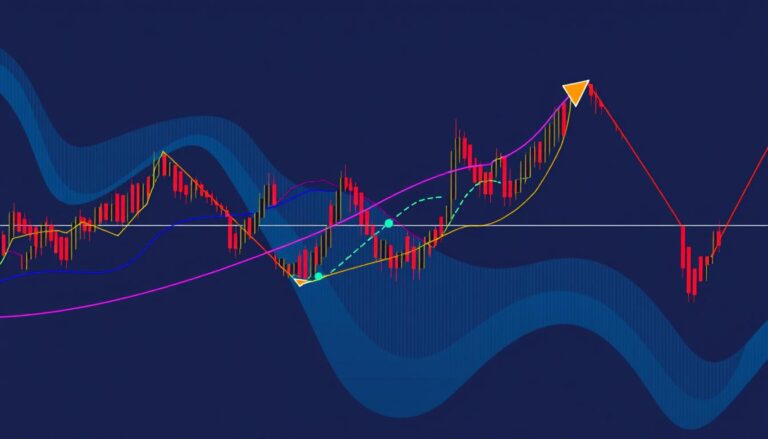

Implementing Crossover Strategies

The tenkan kijun crossover provides clear sinyal for market entry. A bullish signal occurs when the faster line crosses above the slower one.

Location relative to the ichimoku cloud determines signal strength. Crossovers above the cloud create stronger trading opportunities. Those within the cloud suggest neutral conditions.

Traders should confirm with the Chikou Span position. This validation improves sinyal quality and reduces false entries.

Leveraging the Cloud as Dynamic Support and Resistance

The cloud boundaries function as dynamic support resistance zones. When harga trades above the cloud, the top edge acts as primary support.

In bearish conditions, the cloud bottom serves as key resistance. Thicker clouds indicate stronger support or resistance levels.

Traders enter positions at these critical harga levels. This strategy works well for pullback entries during clear trends.

Integrating Ichimoku with Other Technical Indicators

While the Ichimoku system provides comprehensive market analysis, many traders find value in combining it with complementary technical tools. This approach enhances sinyal reliability and reduces false entries. The integration creates a more robust trading framework.

Combining multiple indikator types helps filter market noise. It provides additional confirmation during uncertain conditions. This strategy works particularly well in sideways markets.

Enhancing Analysis with RSI, Volume, and Moving Averages

The Relative Strength Index (RSI) complements Ichimoku by identifying overbought or oversold conditions. When RSI confirms Ichimoku sinyal, traders gain stronger conviction. This combination improves entry timing.

Volume analysis serves as critical confirmation for breakouts. Increased volume validates price movements through cloud boundaries. This data confirms the sustainability of trends.

Traditional moving average lines provide additional trend filters. Longer-period moving average settings offer final confirmation for signals. This indikator teknikal enhances momentum assessment.

Each additional indikator should serve a specific purpose. The goal is confirmation, not clutter. A thoughtful combination helps the trader make informed decisions.

Time Frames and Market Conditions for Optimal Use

Market conditions and timeframe selection play crucial roles in determining trading strategy success. The indikator ichimoku performs differently across various chart intervals. Traders must understand these dynamics to maximize effectiveness.

Choosing the Right Time Frame: H1, H4, or Daily

Medium to higher timeframes like H1, H4, and daily charts produce clearer sinyal. These intervals filter out market noise effectively. Lower timeframes often generate excessive false signals due to volatility.

Day trader typically prefer H1 charts for intraday analysis. Swing traders favor H4 or daily charts for capturing medium-term pergerakan. The system works best when markets show clear directional tren.

Avoiding False Signals in Sideways Markets

The indikator ichimoku struggles during consolidation phases. When harga oscillates within a thin, flat cloud, signals become unreliable. This occurs frequently in sideways pasar conditions.

Traders should identify unsuitable market periods. Horizontal Tenkan-sen and Kijun-sen lines indicate ranging markets. Patience during these phases prevents unnecessary trading losses.

The most profitable setups emerge after clear breakouts. Waiting for strong tren establishment improves signal quality. This approach maximizes the system’s strengths.

Practical Trading Examples Using the Ichimoku Framework

Examining actual trading scenarios reveals how this framework performs in live market conditions. Real-world applications bridge the gap between theory and practice.

Real-World Applications on GBP/JPY and US500

The GBP/JPY pair demonstrated a clear bearish setup in mid-August. Price broke decisively below the cloud, generating a strong sell sinyal. This pergerakan harga resulted in over 300 pips of decline.

Traders monitored the position for a Tenkan-sen and Kijun-sen crossover as an exit signal. This crossover indicated the short-term downtrend completion. The strategy showed disciplined trade management.

US500 exhibited a strong uptrend with price consistently above the cloud. In mid-May, a bearish cross appeared but was ignored due to the dominant tren. The subsequent bullish cross provided a valid entry sinyal.

Adapting Strategies to Various Market Conditions

Successful trading requires adapting approaches to different pasar characteristics. Volatile forex pairs need tighter stops than slower-moving indices.

Traders must recognize different market phases. Strong trends, weakening trends, and potential reversals each demand specific adjustments. Position sizing and profit targets should reflect current harga behavior.

Documenting trades creates a valuable feedback loop. This practice improves pattern recognition over time. Each perubahan in market conditions offers learning opportunities for refined strategy application.

Risk Management and Exit Strategies with Ichimoku

Protecting capital through strategic stop-loss placement is fundamental to sustainable trading. The system provides clear titik for both entry and exit decisions. This approach helps traders manage risk effectively.

Proper position management transforms trading from gambling to calculated investing. Traders define their maximum loss before entering any position. This discipline prevents emotional decision-making during market fluctuations.

Setting Stop Losses Based on Cloud Boundaries

The cloud boundaries offer logical level for protective stops. In long positions, stops can be placed below the cloud’s lower edge. This provides technical justification for the stop placement.

Alternative approaches include placing stops beyond key garis. The Kijun-sen line often serves as a dynamic support or resistance level. Stop distance should reflect the trader’s risk tolerance and time periode.

Defining Exit Points Through Signal Reversals

Exit signals occur when component lines cross in the opposite arah. A bullish trade exit triggers when the Tenkan-sen crosses below the Kijun-sen. This systematic approach removes guesswork from position management.

Traders can also use price movement relative to the cloud for exit decisions. When harga breaks through key boundaries, it may signal trend reversal. Combining multiple confirmation methods improves exit timing accuracy.

Final Thoughts on Mastering Ichimoku Cloud for Trading Success

Successful market analysis depends on tools that deliver holistic views of price action and trend dynamics. The ichimoku kinko hyo system stands out as a complete framework rather than a simple indikator. Its enduring value comes from integrating multiple komponen into one cohesive gambaran.

Mastering this approach requires understanding how each elemen interacts. The tenkan-sen kijun-sen relationship reveals momentum shifts. Meanwhile, the senkou span and chikou span provide crucial context for pergerakan harga.

Traders should practice interpreting these signals systematically. Demo accounts offer safe environments for building confidence. Regular review of both successful and unsuccessful setups accelerates learning.

The system performs best in trending pasar conditions. Patience during consolidation phases prevents false signals. Combining this framework with sound risk management creates a robust trading methodology for long-term success.