Calculate Lot Size MT4: Forex Trading Explained

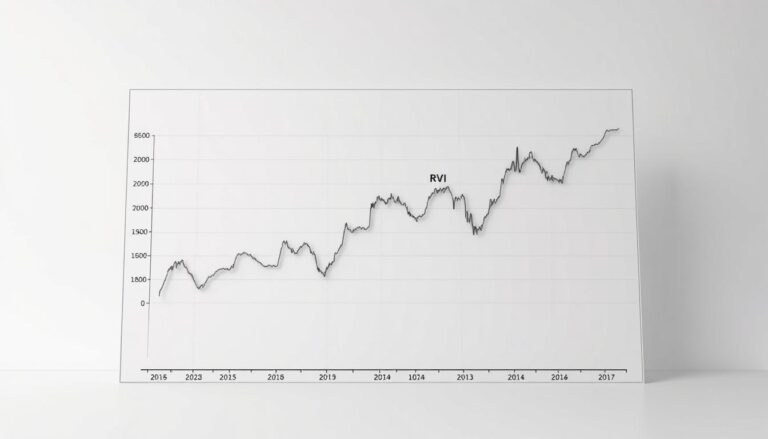

Forex trading demands more than market predictions – it requires disciplined risk management. One critical factor often overlooked by newcomers is determining how much capital to risk per transaction. This decision directly influences potential profits, losses, and long-term account stability.

The volume of currency units bought or sold acts as a financial lever in trading strategies. Larger positions amplify both gains and losses, making balanced decision-making essential. Platforms like MetaTrader 4 provide the framework for executing trades but leave position sizing entirely in users’ hands.

Seasoned market participants recognise that proper trade volume selection separates sustainable strategies from reckless gambling. It protects accounts during unexpected market swings while allowing controlled growth during favourable conditions. Those who neglect this principle often face avoidable setbacks early in their trading journey.

Modern platforms offer tools to help assess appropriate exposure levels, though traders must still input values manually. Understanding these mechanics becomes particularly vital when dealing with margin requirements and leverage ratios common in currency markets. Developing this skill early creates a foundation for consistent decision-making across various market conditions.

For UK-based traders navigating volatile exchange rates, aligning position sizes with personal risk thresholds remains non-negotiable. This approach helps maintain emotional discipline while capitalising on strategic opportunities in the £5 trillion daily forex marketplace.

Fundamentals of Lot Size in Forex Trading

Currency markets operate through standardized units that shape risk exposure and profit potential. Mastering these units helps traders align positions with their financial goals while managing volatility in fast-paced environments.

Defining Standard, Mini, Micro, and Nano Lots

Professional platforms use four primary units for executing trades. A standard lot equals 100,000 units of the base currency, typically used by institutional investors. Smaller accounts often utilize mini (10,000 units) or micro lots (1,000 units) for precise adjustments.

Nano lots represent 100 units, allowing beginners to test strategies with minimal capital. These fractional options enable traders to maintain consistent risk percentages across different account sizes.

Understanding Pip Values and Their Impact

Each pip movement’s financial effect depends directly on trade volume. In major pairs like EUR/USD, a standard lot creates $10 fluctuations per pip. Micro lots reduce this to $1, offering tighter control over potential gains or losses.

Currency conversions become crucial when trading exotic pairs. A GBP-denominated account trading USD/JPY would calculate pip values through current exchange rates. This ensures accurate profit projections and risk assessments.

Strategic traders often mix lot types to balance aggressive positions with protective measures. This approach maintains portfolio stability during sudden market shifts while capitalizing on high-probability opportunities.

Navigating MT4: Accessing Contract Specifications and Details

Successful forex strategies rely on precise trade execution parameters. MetaTrader 4 streamlines this process through its contract specification features, which outline essential rules for every currency pair.

Locating the Specification Window in MT4

Traders access vital trading rules through the Market Watch panel. Right-click any currency pair and select “Specification” to view critical data. This window reveals contract sizes, volume limits, and incremental adjustments for each instrument.

The EUR/USD details show 100,000 base currency units per standard contract. Most brokers allow positions as small as 0.01 lots, ideal for testing strategies with minimal risk. Maximum limits often cap at 20 lots per single transaction to prevent overexposure.

Volume steps dictate precision in position sizing. With 0.01 increments, traders can fine-tune their exposure to match account balances and risk tolerance. These settings help maintain consistency across different market conditions.

Understanding these specifications prevents order rejections and ensures trades align with platform capabilities. UK traders should verify these details regularly, as brokers may adjust requirements during volatile market periods.

Calculate Lot Size MT4: A Step-by-Step Formula Guide

Precision in position sizing separates strategic traders from impulsive market participants. This systematic approach ensures every decision aligns with predefined financial boundaries, transforming emotional reactions into calculated moves.

Risk Amount and Stop Loss Calculation

Effective money management starts with two non-negotiable figures. First, decide the maximum capital you’re willing to risk per transaction – often 1-2% of account balance. Second, identify your protective exit point based on technical analysis or support levels.

For GBP traders, measuring pip distances requires attention to quote currency denominations. A 50-pip buffer on GBP/USD means different monetary values than the same distance on USD/JPY. Always convert pips to account currency for accurate assessments.

Formula Breakdown and Practical Examples

The core equation simplifies complex decisions: (Risk Amount) ÷ (Stop Loss in Pips) = Position Size. Consider these scenarios:

- £150 risk with 75-pip protection: £150 ÷ 75 = £2 per pip → 0.20 standard lots

- €300 exposure limit at 30-pip distance: €300 ÷ 30 = €10 per pip → 1 mini lot

Broker-specific contract sizes influence final execution. Most platforms allow 0.01 increments, enabling micro-adjustments for perfect alignment with risk thresholds. Always verify minimum/maximum limits before placing orders.

This methodology adapts seamlessly across currency pairs and market conditions. Traders dealing with cross pairs like GBP/AUD must factor in pip value conversions, ensuring calculations reflect true account currency exposure.

Setting Up Your Trade’s Risk Parameters

Balancing risk and reward defines sustainable trading strategies. Establishing clear boundaries protects capital while allowing strategic growth opportunities. Two elements demand attention: acceptable exposure per transaction and protective exit triggers.

Determining Risk per Trade and Setting Stop Loss

Professional traders rarely stake more than 1-3% of their account balance on any single position. This percentage-based approach prevents catastrophic losses during inevitable market reversals. For a £10,000 portfolio, a 2% risk limit translates to £200 maximum exposure per transaction.

Stop loss placement combines technical analysis with volatility assessments. Effective levels sit beyond normal price fluctuations but close enough to prevent excessive losses. Consider these scenarios:

- 25% risk per trade: Four consecutive losses erase 100% of capital

- 2.5% risk per trade: Same loss streak preserves 90% of balance

Emotional discipline strengthens when predefined rules govern position sizing. Traders should evaluate both financial capacity and psychological comfort before executing trades. Conservative approaches often outperform aggressive strategies long-term.

Advanced frameworks incorporate multiple safeguards:

- Daily loss limits (5% maximum)

- Correlation checks between positions

- Volatility-adjusted stop distances

UK traders facing GBP volatility should reassess parameters quarterly. Market shifts demand flexible yet consistent risk management to navigate currency fluctuations effectively.

Utilizing Lot Size Calculators and Tools for Efficient Trading

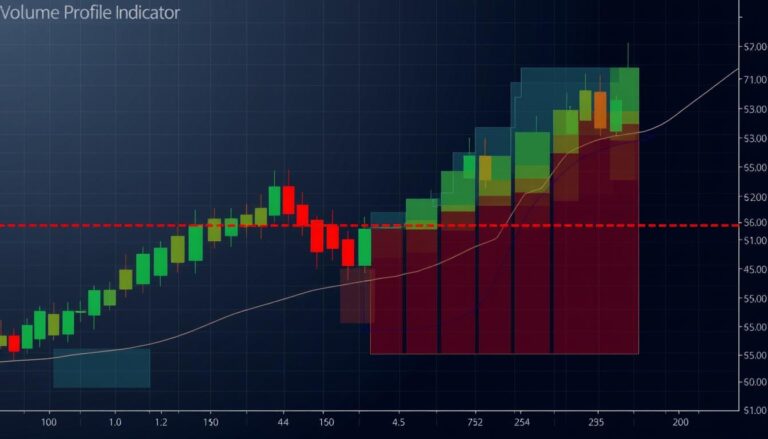

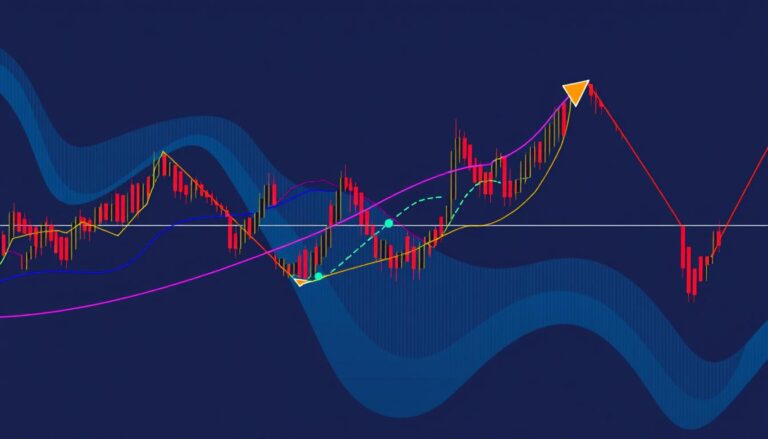

Modern trading platforms integrate advanced automation to streamline strategic decisions. Specialized indicators transform complex mathematics into visual interfaces, letting traders focus on market analysis rather than manual computations.

Automated Precision in Position Management

The MT4 lot size calculator eliminates guesswork by linking risk parameters to real-time market data. Users drag profit targets and protective stops directly onto charts, with instant updates to exposure levels. This visual approach helps maintain discipline during fast-moving sessions.

Customizable settings adapt to individual strategies. Traders set percentage-based limits or fixed monetary risks, ensuring consistency across transactions. Real-time profit/loss projections appear before order execution, creating clear expectations for every move.

These tools particularly benefit UK participants navigating GBP volatility. By locking in risk-reward ratios upfront, traders can execute positions confidently while adhering to personal financial boundaries. The result? Fewer emotional decisions and more systematic growth in dynamic markets.